The document is used to form the following operations in the management, accounting. and cash accounting:

* Release of products made in the shop. It can be of two types:

o with posting to the place of storage;

o without posting to a storage location with display in work in progress, display in general business, general production or other costs.

* Provision of internal service by the production unit.

* Posting of returnable waste to the place of storage from production.

* Formation in the accounting of data on the distribution of direct costs for output:

o Material costs and returnable waste - in quantitative terms;

o Technological operations and Other costs - in value terms.

At the top of the document, it is permissible to specify the following parameters:

* Storage. The storage location for the released product. The content of the parameter is set from the "Warehouses" reference book.

* Division. A manufacturing unit that produced products or provided internal services. The content of the parameter is set from the directory "Subdivisions". The parameter is required to be entered.

* Department of the organization. The production unit of the organization in which the product was produced or internal services were provided. The content of the parameter is set from the directory "Enterprise divisions".

The parameter must always be defined.

* Task for production. The production task is selected if the production output is tied to a particular production task, in which case the production task will be considered completed in terms of the products released for it.

* Allow exceeding the limit. In order for the user to be able to set the write-off of materials for costs over the limit, in the set of additional rights, the content of the right "Change the permission to exceed the limit of the issue of materials" must be set to the content "True". In this case, the flag "Allow exceeding the limit" is made available to the user. If the flag is enabled, then it will be permissible for the document to write off any amount of materials for expenses, regardless of the value of the specified limit. In this case, the total amount of material to be written off must be specified in the "Quantity" parameter on the "Materials" panel, and the volume exceeding the contents of the limit must be explicitly selected and defined in the "Including released over the limit" column of the "Recipients" tabular section. The column is made visible when the "Allow limit exceeding" flag is set. Limits are controlled only if the direction of manufacturing products in the document is set to "For costs" or "For costs (list)".

The visibility of a number of parameters and bookmarks of the document is controlled in a separate window called by pressing the button

"Setting":

* Apply materials. If the flag is set, then the "Materials" panel is visible. On this tab, a list of materials used in the production of products is filled out.

* Automatically distribute materials. The flag specifies manual or automated distribution of materials for release. If the flag is not set, then the Material Distribution panel is visible.

* Apply technological operations. If the flag is set, then the panel "Tech. operations" is visible. On this tab, a list of completed technological operations in the production of products is filled in.

* Automatically distribute those. operations. The flag specifies manual or automated distribution of costs for technological operations. If the flag is not set, then the panel "Distribution of those. operations" is visible.

* Apply other costs. If the flag is set, then the panel "Other costs" is visible. On this tab, a list of other intangible costs incurred in the production of products is filled out.

* Automatically allocate other costs. The flag specifies manual or automated allocation of other release costs. If the flag is not set, then the panel "Distribution of other costs" is visible.

* Apply returnable waste. If the flag is set, then the "Returned Waste" panel is visible. On this tab, a list of recyclable waste received during the production of products is filled in.

* Automatically distribute returnable waste to products. The flag specifies manual or automated distribution of returnable waste to products. If the flag is not set, then the "Distribution of returnable waste" panel is visible.

* Apply operating time. If the flag is set, then it is permissible to fill in the document with data not only on the release of finished products, but also data on the operating time. When the flag is on, the following parameters become available for filling in the data: Type of manufacture, Including refinishing.

* Apply jobs to production. If the flag is set, then in the upper part of the document the “Production task” parameter becomes available for filling, it is permissible to link the production data to the production task, thereby indicating the completion of the production task. The case of automated input of the “Products” tabular part according to the production order specified in the upper part of the document is made available.

* Apply orders. If the flag is set, then the parameters become available for filling

"Order-Cost", "Order-Issue", "Order-Reserve/Placement" to define orders to which you can link output and output cost data.

* Apply OS service orders. If the flag is set, then in the "Products" tabular section in the "Issue" parameter, the case "OS maintenance order" is made available for selection, so the release of products or the provision of services can be tied to an OS maintenance order.

* Apply manufacturing directions. If the flag is set, then the choice of directions for manufacturing products is made available - for a storage location, for costs of a single direction, for costs in several directions.

The “Manufacturing Direction” parameter is made available for filling in the “Products” tabular section, the “Recipients” panel is made visible, the “Recipients” button on the menu of the “Products” tabular section is made visible. If the flag is not set, then the entire output goes to the storage location specified at the top of the document.

* Apply subdivisions of WIP. If the flag is set, then in the "Materials distribution" tabular section, the parameters "WIP division", "WIP organization division" become available for filling in the data.

* Apply WIP analytics. If the flag is set, then in the tabular section "Materials distribution" the parameters "Nomenclature group of WIP", "Order of WIP" become available for filling in the data.

Panel "Products and Services"

The panel selects manufactured finished products, semi-finished products or rendered internal services:

* Product/service. A product or service provided. The content of the parameter is set from the reference book "Nomenclature" and must always be defined.

* Characteristics of products. Characteristics of manufactured products, if accounting by characteristics is created for this product. The content of the parameter is set from the "Nomenclature characteristics" reference book.

* Series of products. A series of manufactured products, if batch accounting is created for this product. The content of the parameter is set from the "Nomenclature series" reference book.

* Type of manufacture. Type of production and provision of services. It is available if the "Use operating time" flag is set in the parameters visibility settings. The parameter can take the following values:

o Release - sets the case for the final production of products;

o Operating time - a case of work in progress is set, for which costs are applied.

* Direction of manufacture. Direction of production refers to the method of subsequent accounting for manufactured products - either the product is transferred to a storage location, or remains in production and is transferred to another production unit. The parameter is used to determine the direction of production in the document.

Direction of Manufacturing in the Products and Services panel, and the Recipients panel. These parameters are available if the checkbox is set in the parameter visibility settings (called when the "Settings" button is pressed).

"Use manufacturing directions". For operating time, the direction of manufacture is not indicated. All operating time remains in the unit that produced it. It is not possible to transfer the operating time to another department or to a storage location. The contents of the parameter "Direction of production" by default can be set in the user settings. The following production lines are available for selection:

o To the place of storage. The release of products is carried out with posting to the place of storage. The storage location is selected at the top of the document;

o For costs. Products are released without posting to the storage location, the direction of write-off of manufacturing costs is selected on the "Recipients" panel. With this method, only one write-off direction is available for the production line;

o For costs (list). Products are released without posting to the storage place, the direction of write-off of production costs is selected in the opening window "Enter directions of write-off of products (services)", which appears when you click the "Recipients" button on the "Products and Services" tab menu.

When setting the direction of manufacturing products (whether it is one direction or a list of directions), it is required to assign the values of all parameters to account for the costs associated with the release of products. These details are:

The division to which the costs belong (the division of the enterprise for management accounting and the division of the organization for reg.);

Cost item;

Buyer's order or production order;

Cost accounts for reg. accounting and corresponding accounts analytical data;

When setting the list of directions, it is necessary to determine the coefficient of distribution of costs by directions.

For frequent use of the same combinations of values of parameters for describing the direction of manufacture, it is permissible to assign them to a template. To do this, use the directory "Directions for writing off products (services)". Further, in the document “Production report for a shift”, it is permissible to enter parameters for the direction of manufacturing products based on a template. If a list of manufacturing directions is specified, then the template is used in the list setting window by pressing the "Fill" - "Fill from template" button. If one production direction is indicated, then on the "Recipients" panel, to enter data according to the template, you need to click the "Fill" - "Fill from template" button.

* Quality. The quality of the manufactured products. For services, this parameter is not entered. The content of the parameter is set from the "Quality" reference book.

* Seats. The number of places of manufactured products.

* Unit. A unit of measure for manufactured products.

* Quantity. The number of manufactured products in the storage unit of residues. The content of the parameter is entered automatically when specifying the number of seats.

* Including finishing touches. if “Output” is selected in the “Type of production” parameter, and the total volume of manufactured products is selected in the “Quantity” parameter, then in order to connect the output with the operating time, in the “Including refinishing” parameter, the volume of products for which the operating time is essentially completed is selected.

* Share of cost. Share of cost to allocate costs.

* Nomenclature group. A nomenclature group for the manufacture of products is selected. The content of the parameter is set from the "Nomenclature groups" directory and is entered automatically during product selection by the value specified in the "Nomenclature" directory in the "Nomenclature group" field.

*Order costs. An order is selected to generate production costs. The content is set from the lists of documents "Order of the buyer" or "Order for production".

* Order issue. The order for the execution of which the production is carried out. The content is set from the lists of documents "Order for production" or "Order for maintenance of OS".

* Reserve order. It is entered if you need to reserve manufactured products under the order. The content is set from the lists of documents "Buyer's order", "Internal order" or "Production order".

* Specification. The specification of the manufactured product or service is selected. The content of the parameter is set from the "Nomenclature Specifications" reference book.

* End products. The parameter is available if the "Use production orders" checkbox or the "Apply OS service orders" checkbox is selected in the document setup. During document posting, a case of execution of planned production according to the required task or order is recorded.

* Party status. Specifies the status of the batch, which allows you to distinguish between goods and materials in batch accounting.

For bookkeeping tasks. and cash accounting for manufactured products reflect:

* Invoice accounting. Account of accounting for manufactured products (for example, 26 or 25).

* Cost account. Cost accounting account for the production of products or the provision of services (for example, 231 or 232).

* Article of gain-loss.

* Tax appointment.

Options button. In production, the consumption of components can depend on the additional details of the product (dimensions, temperature) or on the details of the manufacturing process itself (humidity). In the specification, it is possible to set the dependence of the consumption of components on the details of the manufacture of products.

The actual values of manufacturing details are reflected in the shift production report for each record of finished products. To do this, you need to make the active line in the tabular section "Products and Services" and click the "Parameters" button. A dialog box will appear for filling in the actual values of the details of the production of products.

* Fill in according to the order for production. Data on the products that are in the production task specified in the upper part are added to the lower table; at the same time, the lower table is cleared beforehand.

* Enter from the buyer's order. Data on products and services from the customer's order, which is specified by the user in the selection window, is added to the lower table, at the same time, lines are added to the lines already in the tabular part.

* Fill in according to the production order. In the lower table, data on products and services from the production order, which is specified by the user in the selection window, is added, at the same time, the lower table is cleared in advance. The entry is made for the unfulfilled part of the production order.

* Submit by order for production. Similar to "Fill in by order for production", but without deleting existing lines in the tabular section.

Recipients Panel

The panel reflects data for the formation of manufactured products or services in work in progress, in general business, general production or other costs, if the release is performed without posting to the storage location. Each line of the "Recipients" bookmark is an extension of the corresponding bookmark line

"Products and Services". Entering new lines, deleting, sorting on this tab are not available.

* Division. The department is the recipient of the costs. The content of the parameter is set from the reference

"Subdivisions".

* Department of the organization. The organizational unit is the recipient of the costs. The content of the parameter is set from the directory "Enterprise divisions".

* Order. A buyer's order or a production order is selected, in which costs are formed. The content is set from the list of documents "Order of the buyer" or "Order for production".

* Cost item. A cost item that is used to form manufactured products or rendered services.

Entering this parameter means the case of the formation of manufactured products or services rendered in costs. The content of the parameter is set from the reference book "Cost Items".

* Including released over the limit. The quantity of products that will be written off as costs in excess of the limit is selected. Data is reflected only if: the algorithm for limiting the release of materials and semi-finished products to subdivisions is applied, the checkbox “Allow the limit to be exceeded” is set in the upper part of the document, the write-off of products goes to costs, and not to the storage location.

* Har-r costs. The column displays the nature of the costs required by the cost item selected in the line.

* Analytical data. Analytical data of the cost item. The values entered in this column depend on the nature of the costs selected in the line of the cost item.

* Cost account. The accounting account on which the costs are generated. The content of the parameter is set from the chart of accounts and entered automatically during the selection of the cost item.

It is permissible to fill in the lower table automatically by pressing the "Fill" - "Fill from template" button. In documents

The “Shift production report” for each record of manufactured products is required to determine the direction of production.

If the case "for costs (list)" is specified, then the input of the direction of write-off of production costs is selected in the opening window "Enter directions of write-off of products (services)". For frequent use of the same combinations of values of parameters for describing the direction of manufacture, it is permissible to assign them to a template.

For this purpose, the reference book "Directions for writing off manufactured products (services)" is used.

Materials panel

The flag "Fill in cost items by lines" specifies how the cost items on this tab will be filled. Setting this flag specifies the definition of a cost item in each line of the tabular section.

* Cost item. A cost item is selected for which materials and semi-finished products in work in progress were displayed. The content of the parameter is set from the reference book "Cost Items". In the parameter, it is permissible to specify only items with the type of costs "Material".

The tabular part reflects the materials and semi-finished products that were used for the manufacture of products, the provision of services:

* Material. Used material. The content of the parameter is set from the "Nomenclature" reference book.

* Characteristics of the material. Characteristic of a material, if accounting by characteristics is created for this material. The content of the parameter is set from the "Nomenclature characteristics" reference book.

* Series of material. A series of a material, if batch accounting is created for this material. The content of the parameter is set from the "Nomenclature series" reference book.

* Seats. Number of places of used material.

* Unit. The unit of measure for the used material.

* Quantity. The amount of used material in the storage unit of residues. The content of the parameter is entered automatically when specifying the number of seats.

* Type of manufacture. The type of manufacture of the product to which the material was applied. The content of this parameter must be identical to the values specified in the Products and Services panel.

*Order costs. The cost order for the product to which the material was applied. The content of this parameter must be identical to the values specified in the Products and Services panel.

* Order issue. The order for which the material was applied. The content of this parameter must be identical to the values specified in the Products and Services panel.

* Specification. The specification according to which the material was used.

It is permissible to fill in the lower table automatically by pressing the "Fill" button. The following inputs are allowed:

* Fill in according to the specification. Data on materials according to the specification is added to the lower table.

* Fill in with the selection of analogues. When filling out, it is possible to replace materials with analogues. Replacement is made in the assistant window "Selection of materials and analogues for the manufacture of products", which displays information about acceptable analogues, about the remains of materials and analogues in work in progress and in stock. At the same time, if the same analogue is implemented for different materials, its free balance will be distributed commensurately over all materials.

* Fill in the rest. Data on materials are added to the lower table according to the balances that are at the time of entering the document in work in progress.

* Fill in as needed. The lower table is entered according to the list of materials specified on the panel

"Materials" in the document "Order for production", at the same time, the entry is performed according to the current (not closed) needs of this order for production. The "Order for production" documents, for which the entry must be performed, are determined by the orders that are indicated in the "Order-Issue" column on the panel

"Product" in the shift production report. If in the tabular section on the "Materials" panel in the production report for the shift there were already entered lines, then they will be deleted during automated entry according to needs.

* Contribute from the requirement-invoice. The user sets the document "Requirement-invoice". The tabular part is entered according to the list of materials specified in the document "Requirement-invoice" on the panel

"Materials", at the same time, the lines are added to the lines already in the tabular part.

Material Distribution Panel

In the tabular section, the distribution of materials and semi-finished products specified on the panel is selected

"Materials" for manufactured products and services rendered, specified on the "Products and Services" panel.

* Material, Material characteristic, Material series, Cost item. The required values from the tabular section on the "Materials" panel. The “Cost Items” parameter is available for change if the “Fill in Cost Items by Lines” flag is set on the “Materials” panel.

* Quantity. Quantity of material in the storage unit of residuals.

* Nomenclature group, Products, Product characteristics, Product series, Type of manufacture, Order costs,

Order Release, Specification, Cost Invoice, Quality. The required values from the tabular section on the "Products and Services" tab.

* WIP Division, WIP Organization Division. Available if the "Use WIP division" flag is set in the parameter visibility settings.

* WIP item group, WIP order. Available if the flag is set in the parameter visibility settings

"Use WIP analytics."

It is envisaged that this tabular part will be entered when the "Fill" button is pressed. Materials and semi-finished products specified in the "Materials" panel are divided by manufactured products in proportion to the values in the "Cost share" column. Each material is distributed only to those lines of production, the specification of which includes the given material. Materials for which a buyer's order is defined are split only into the production of products for this order.

Panel "Tech. operations"

The panel in the tabular section reflects data on the performed technological operations:

* Technological operation. Completed technological operation. The content of the parameter is set from the "Technological operations" reference book.

* Type of manufacture. The type of product manufacturing in which the technological operation was performed. The content of this parameter must be identical to the values specified in the Products and Services panel.

* Cost item. Cost item for which technological operations in work in progress are formed. The content of the parameter is set from the reference book "Cost Items". In the parameter, it is permissible to specify only intangible items with a cost type not equal to "Material".

* Pricing. Cost per unit of technological operation. The content of the parameter is entered automatically according to the data of the "Technological operations" reference book.

* Currency. Currency of technological operation price. The content of the parameter is entered automatically according to the data of the "Technological operations" reference book.

* Quantity. The number of technological operations performed.

* Amount in the currency of the quote. The amount of completed operations in the currency of the technological operation rate. The content of the parameter is calculated automatically after entering the quantity.

* Sum. The amount of transactions performed in the currency of management accounting. The content of the parameter is calculated from the amount in the rate currency.

* Amount (regl). The amount of transactions performed in the currency reg. accounting. The content of the parameter is calculated from the amount in the rate currency.

* Order. Production cost order (buyer's order or production order), in which the technological operation was performed.

* Type of analytics. The column displays the name of the analytics that you want to define for the cost item selected in the line in the "Analytical data" column.

* Analytical data. Analytical data of the cost item.

* Project. Project or types of distribution by projects. This option is selected if the system creates indirect cost accounting for projects.

For bookkeeping tasks. and cash accounting reflects:

* Cost account. The accounting account on which the executed tech. operations.

* Gross expenditure item.

* Tax appointment.

The tabular part can be filled in automatically according to the production flow chart.

Artists panel

The panel in the tabular part reflects the data on the performers, in fact, the employees are listed and the KTU of each of them is selected:

* Worker. Performer of work (for example, a member of a team of workers). For the order reflected in the regulated accounting, it is also necessary to determine the order for the reception of the employee.

* KTU. The "labor participation rate" allows you to unevenly distribute the amount of the order among the performers. The default is 1.

* Amount to be charged. The amount to be accrued to the employee in the currency of management accounting.

* Amount to be charged (regl). The amount to be accrued to the employee in the currency reg. accounting.

The panel "Distribution of tech. operations"

In the tabular section, the distribution of technological operations specified on the panel "Tech. operations" for manufactured products and services rendered, specified in the "Products and Services" panel.

* Technological operation, Cost item. The required values from the tabular section on the panel "Tech. operations."

* Sum. The amount of transactions performed in the currency of management accounting.

* Amount (regl). The amount of transactions performed in the currency reg. accounting.

Specification, Cost Account, Quality. The required values from the tabular section on the "Products and Services" panel.

It is envisaged that this tabular part will be entered when the "Fill" button is pressed. Technological operations specified on the panel "Tech. operations”, divided by manufactured products in proportion to the values in the column “Cost share”. Those. operations for which a buyer's order is defined are divided only into the output of products for this order.

Panel "Other costs"

The panel in the tabular part reflects data on other intangible costs:

* Cost item. A cost item for which other costs in work in progress are displayed. The content of the parameter is set from the reference book "Cost Items". In the parameter, it is permissible to specify only intangible items with a cost type not equal to "Material".

* Distribution method. The cost allocation method specifies the basis on which the costs will be divided during the calculation of the document "Calculation of the cost of production". This is essentially analytical data, according to which the costs are displayed in WIP.

* Nomenclature group. Nomenclature group for the manufacture of products to which other costs belong.

The content of this parameter must be identical to the values specified in the Products and Services panel.

* Type of manufacture. Type of production of products to which other costs belong. The content of this parameter must be identical to the values specified in the Products and Services panel.

* Order. Order costs of products to which other costs belong. The content of this parameter must be identical to the values specified in the Products and Services panel.

* Amount (regl). The amount of other costs in the currency reg. accounting. The content of the parameter is calculated automatically when changing the amount in the control currency. accounting.

When clicking the button "Fill" - "Fill by balances", the lower table is entered with the balances of intangible costs in work in progress;

Other Cost Allocation panel

In the tabular section, the distribution of other costs specified on the "Other Costs" panel for manufactured products and services rendered, specified on the "Products and Services" panel, is selected.

* Cost item. Values of the required parameters from the tabular section on the "Other costs" panel.

* Sum. The amount of other costs in the currency of management accounting.

* Amount (regl). The amount of other costs in the currency reg. accounting.

* Nomenclature group, Products, Product characteristics, Product series, Type of manufacture, Order,

Specification, Cost Account, Quality. Values of the required parameters from the tabular section on the panel

"Products and Services".

It is provided that this tabular part is entered when the "Fill" button is pressed. Costs set on the panel

“Other costs” are divided by manufactured products in proportion to the values in the “Share of cost” column. Other costs are divided for the production of products for the same item group and order, which are indicated in the line of the tabular part "Other costs".

Recycled Waste Panel

For returnable waste, it is possible to define a separate storage location for transfer, the storage location is defined in the parameter

"Warehouse" in the "Return Waste" panel.

The tabular part reflects the returnable waste that was generated during the production of products:

* Nomenclature. Return waste. The content of the parameter is set from the "Nomenclature" reference book.

* Characteristics of the nomenclature. Characteristic of returnable waste, if accounting by characteristics is created for this returnable waste. The content of the parameter is set from the "Nomenclature characteristics" reference book.

* Nomenclature series. Returned waste series, if series accounting is created for this returnable waste.

The content of the parameter is set from the "Nomenclature series" reference book.

* Seats. Number of places of returned waste received.

* Unit. The unit of measure for the returned waste received.

* Quantity. Quantity of returnable waste received in the residue holding unit. The content of the parameter is entered automatically when specifying the number of seats.

* Type of manufacture. The type of product manufacturing in which the returnable waste was received. The content of this parameter must be identical to the values specified in the Products and Services panel.

*Order costs. The order is the cost of the product in which the returnable waste was received. The content of this parameter must be identical to the values specified in the Products and Services panel.

* Reserve order. It is entered if it is necessary to reserve returnable waste under the order. The content is set from the lists of documents "Buyer's order", "Internal order" or "Production order".

* Nomenclature group. The nomenclature group for the manufacture of products is selected

* Specification. The specification of the manufactured product or service is selected according to the release of which the returnable waste is obtained. The content of the parameter is set from the "Nomenclature Specifications" reference book.

* Party status. Specifies the status of the batch, which allows you to distinguish between goods and materials in batch accounting. For returnable waste that belongs to the supplier, the status of the batch "For recycling" is selected.

It is provided that this tabular part is entered when the "Fill" button is pressed. The entry is based on the manufacturing specifications that are set in the Products and Services panel.

Panel "Distribution of returnable waste"

In the tabular section, the distribution of returnable waste specified on the "Returned Waste" panel for manufactured products and services rendered, specified on the "Products and Services" panel, is selected.

* Nomenclature, Nomenclature characteristic, Nomenclature series, Cost item. Values of the required parameters from the tabular section on the "Return Waste" panel.

* Quantity. Quantity of returnable waste in the residue holding unit.

* Nomenclature group, Products, Product characteristics, Product series, Manufacturing type, Cost order,

Reserve Order, Specification, Cost Invoice, Quality. Values of the required parameters from the tabular section on the "Products and Services" panel.

It is envisaged that this tabular part will be entered when the "Fill" button is pressed. The nomenclature defined on the "Returnable waste" tab is distributed among manufactured products in proportion to the values in the column

"Share of cost". Each returnable waste is distributed only to those lines of production, the specification of which includes a given returnable waste. The lines in which the buyer's order is defined are distributed only for the production of products for this order.

The nuances of the

If the accounting policy assigns the cost creation method for a manufacturing operation as “At planned cost” or “At direct costs”, then during the document posting, the preliminary cost of materials is determined, according to the accounting data in work in progress, and distribution is made according to the number of direct costs of this material on the lines of the tabular part "Products and Services". As a result, the preliminary cost of manufactured products and services rendered is created.

During the posting of the “Production report for a shift” document, the requirements for the production order specified in it are closed if:

* an accounting of the needs of production orders is created (in the settings of the accounting parameters, the checkbox

"Keep records of the needs of orders for production in materials and semi-finished products");

* when applying the "Automatic at distribution" method of closing requirements, the closing of requirements is performed based on the data in the "Materials distribution" panel. If, as a result of posting the document, all products planned for release according to the production order specified in it are completely released, the requirement for the production order is closed in full, regardless of the information specified on the "Materials distribution" panel;

* when using the "Explicitly" method of closing requirements, requirements are closed if, as a result of posting the document, all products planned for release according to the production order specified in it are completely released. At the same time, the demand for the production order is closed in full, regardless of whether you enter the "Materials distribution" tab.

The document is intended to reflect the following operations in management, accounting and tax accounting:

- Release of products produced in the shop. It can be of two types:

- with posting to the warehouse;

- without posting to the warehouse with reflection in work in progress, reflection in general business, general production or other costs.

- Provision of internal services by the production unit.

- Posting of returnable waste to the warehouse from production.

- Reflection in the accounting of data on the distribution of direct costs of production:

- Material costs and returnable waste - in quantitative terms;

- Technological operations and Other costs - in value terms.

In the header of the document, you can select the following details:

- Stock. The storage location for the released product. The attribute value is selected from the "Warehouses" directory.

- Subdivision. The manufacturing unit that produced products or provided internal services. The attribute value is selected from the "Subdivisions" reference book. The requisite is obligatory for filling.

- Organization division . The production unit of an organization in which a product was produced or an internal service was provided. The value of the attribute is selected from the reference book "Subdivisions of organizations". The requisite is obligatory for filling.

- Production order . A production order is indicated if the output is tied to a specific production order, in which case the production order will be considered completed in terms of the products released under it.

- Allow over limit . In order for the user to be able to specify the write-off of materials for costs over the limit, in the set of additional rights, the value of the right "Edit permission for exceeding the limit of the issue of materials" must be set to "True". In this case, the checkbox " Allow exceeding the limit". If the checkbox is enabled, then the document can write off any amount of materials for costs, regardless of the value of the set limit. In this case, the total amount of the written off material must be indicated in the "Quantity" variable on the "Materials" tab, and the volume exceeding the limit value must be clearly marked and indicated in the "Incl. released in excess of the limit" of the "Recipients" tabular section. The column becomes visible when the "Allow limit exceeding" checkbox is checked. Limit control is performed only if the direction of output in the document is set to "To costs" or "To costs (list)".

The visibility of a number of details and bookmarks of the document is controlled in a separate window called by the button " Setting»:

- Use materials . If the checkbox is checked, then the "Materials" tab is visible. On this tab, a list of materials used in the production of products is entered.

- Automatically distribute materials . The checkbox defines manual or automatic distribution of materials for release. If the checkbox is unchecked, then the Material Distribution tab is visible.

- Use technological operations . If the box is checked, then the tab "Tech. operations" is visible. On this tab, a list of completed technological operations in the production of products is entered.

- Automatically distribute those. operations . The checkbox defines manual or automatic distribution of costs among technological operations. If the checkbox is not checked, then the tab "Distribution of those. operations" is visible.

- Use other costs . If the checkbox is checked, then the "Other costs" tab is visible. On this tab, a list of other non-material costs incurred in the production of products is entered.

- Automatically allocate other costs . The checkbox defines manual or automatic allocation of other release costs. If the checkbox is not selected, then the tab "Distribution of other costs" is visible.

- Use returnable waste . If the checkbox is checked, then the "Returned Waste" tab is visible. On this tab, you enter a list of recyclable waste received during the production of products.

- Automatically allocate returnable waste to products . The checkbox defines manual or automatic allocation of returnable waste to products. If the checkbox is not selected, then the tab "Distribution of returnable waste" is visible.

- Use operating time . If the checkbox is checked, then it is possible to enter data into the document not only for the production of finished products, but also data on the operating time. When the checkbox is enabled, the details become available for data entry: Type of issue, Incl. completion.

- Use production orders . If the checkbox is checked, then the “Production task” attribute becomes available for input in the document header, the output data can be linked to the production task, thereby indicating the completion of the production task. The option to automatically fill in the “Products” tabular section according to the production order specified in the document header becomes available.

- Use Orders . If the checkbox is checked, then the details "Order-Costs", "Order-Issue", "Order-Reserve/Placement" become available for entering to specify orders, to which you can link data on output and output costs.

- Use OS Service Orders . If the checkbox is checked, then in the “Products” tabular section in the “Issue” attribute, the option “Order for OS maintenance” becomes available for selection, that is, the release of products or the provision of services can be linked to an order for OS maintenance.

- Use release directions. If the checkbox is checked, then the choice of product output directions becomes available - to the warehouse, to the costs of one direction, to the costs in several directions. The attribute “Issue direction” becomes available for input in the tabular section “Products”, the tab “Recipients” becomes visible, the button “Recipients” on the command panel of the tabular section “Products”. If the checkbox is not selected, then the entire output goes to the warehouse specified in the document header.

- Use WIP units . If the checkbox is checked, then in the tabular section "Distribution of materials" the details "WIP department", "WIP organization department" become available for data entry.

- Use WIP analytics . If the checkbox is checked, then in the tabular section "Distribution of materials" the details "Nomenclature group of WIP", "Order of WIP" become available for data entry.

Bookmark "Products and services"

The tab indicates the released finished products, semi-finished products or rendered internal services:

- Product/Service . A product or service provided. The attribute value is selected from the "Nomenclature" reference book and is mandatory.

- Product Feature . Characteristics of the released products, if records are kept for these products by characteristics. The value of the attribute is selected from the reference book "Characteristics of the nomenclature".

- Product series. A series of manufactured products, if records are kept for these products by series. The attribute value is selected from the "Nomenclature series" reference book.

- Release type. Type of output and services. Available if the "Use running time" checkbox is checked in the details visibility settings. The attribute can take the following values:

- Release - determines the fact of the final release of products;

- Operating time - the fact of unfinished production is determined, for which costs are used.

- Release direction . The direction of release is understood as a way of further accounting for manufactured products - either the products are transferred to the warehouse, or remain in production and are transferred to another production unit. To indicate the direction of release in the document, use the attribute "Direction of release" on the tab "Products and services", as well as the tab "Recipients". These requisites are available if the 'Use release directions' checkbox is set in the requisite visibility settings (called by the 'Settings' button). For operating time, the direction of release is not set. All operating time remains in the unit that produced it. The transfer of operating time to another department or warehouse is not possible. The default value of the "Issue direction" attribute can be set in the user settings. The following release directions are available for selection:

- To the warehouse. The release of products is carried out with posting to the warehouse. The warehouse is indicated in the header of the document;

- For costs. Products are released without posting to the warehouse, the direction of write-off of manufacturing costs is indicated on the "Recipients" tab. With this method, only one disposal direction is available for a production line;

- For expenses (list) . Products are released without posting to the warehouse, the direction of write-off of production costs is indicated in the dialog box "Enter directions of write-off of products (services)", which opens by pressing the button " Recipients» on the command panel of the "Products and Services" tab. When setting the direction of product release (whether it is one direction or a list of directions), you need to determine the values of all details to account for the costs associated with the release of products. These details are:

- the subdivision to which the costs relate (subdivision of the enterprise for management accounting and subdivision of the organization for regulated accounting);

- cost item;

- purchase order or production order;

- cost accounts for regulated accounting and corresponding analytics accounts;

- when specifying the list of directions, it is necessary to set the coefficient of distribution of costs by directions.

For frequent use of the same combinations of values for the details of the release direction description, they can be defined in a template. For this purpose, the reference book "Directions for writing off products (services)" is intended. Further, in the document “Production report for a shift”, filling in the details for the direction of production can be performed based on a template. If a list of release directions is specified, then the template is applied in the window for specifying the list by clicking the "Fill" - "Fill from template" button. If one release direction is set, then on the "Recipients" tab, to fill in the data according to the template, you need to click the "Fill" - "Fill from the template" button. - Quality. The quality of the released products. For services, this requisite is not filled. The attribute value is selected from the "Quality" reference book.

- Places. The number of places of manufactured products.

- Unit. A unit of measure for output.

- Quantity. The number of products released in the storage unit of residues. The attribute value is filled in automatically when specifying the number of seats.

- Incl. completion. if “Output” is selected in the “Type of output” variable, and the total volume of manufactured products is selected in the “Quantity” variable, then in order to link the output with the operating time in the “Incl. finishing” indicates the volume of products for which the operating time is actually completed.

- Cost share. Share of cost to allocate costs.

- Nomenclature group . The nomenclature group of output is indicated. The attribute value is selected from the "Nomenclature groups" directory and is filled in automatically when selecting products with the value specified in the "Nomenclature" directory in the "Nomenclature group" field.

- Order costs. An order is specified to reflect the cost of production. The value is selected from the lists of "Buyer's Order" or "Production Order" documents.

- Order release. An order for which production is being produced. The value is selected from the lists of documents "Order for production" or "Order for OS maintenance".

- Reserve order. It is filled in if it is necessary to reserve the released products under the order. The value is selected from the lists of "Buyer's Order", "Internal Order" or "Production Order" documents.

- Specification. Specifies the specification of the product or service provided. The attribute value is selected from the "Nomenclature Specifications" reference book.

- end products . The attribute is available if the "Use production tasks" flag or the "Use OS service orders" flag is set in the document settings. When posting a document, the fact of completion of the planned release according to the corresponding task or order is recorded.

- party status.Specifies the status of the batch, which allows you to distinguish between goods and materials in batch accounting.

For the purposes of accounting and tax accounting of manufactured products, the following shall be indicated:

- Accounting account (BU).The accounting account for manufactured products (for example, 43 or 21).

- Accounting account (NU). Account of the tax accounting of let out production. The attribute value is selected from the chart of accounts for tax accounting.

- Cost account (BU).Cost accounting account for the production of products or the provision of services (for example, 20 or 23).

- Cost Account (NU). Account for tax accounting of costs for the production of products or the provision of services. The attribute value is selected from the chart of accounts for tax accounting.

Button " Options". In production, the consumption of components may depend on additional product parameters (dimensions, temperature) or on the parameters of the production process itself (humidity). In the specification, you can set up the dependence of the consumption of components on the parameters of output. The actual values of output parameters are indicated in the shift production report for each item of finished goods. To do this, you need to make the line active in the tabular section "Products and Services" and click the "Parameters" button. A dialog box opens for entering the actual values of the output parameters.

Fill in"

- Fill in according to the order for production . Data on the products that are in the production task specified in the header are added to the tabular part; in this case, the tabular section is preliminarily cleared.

- Add from customer order . Data on products and services from the customer's order, which is selected by the user in the selection window, are added to the tabular section, while rows are added to the rows already in the tabular section.

- . Data on products and services from the production order, which is selected by the user in the selection window, is added to the tabular part, while the tabular part is preliminarily cleared. Filling occurs on the unfulfilled part of the production order.

- Add by production order . Likewise " Fill in the order for production”, but without deleting existing rows in the tabular section.

Recipients tab

The tab contains data to reflect the released products or services in work in progress, in general business, general production or other costs, if the release is made without posting to the warehouse. Each line of the "Recipients" tab is an extension of the corresponding line of the "Products and Services" tab. Entering new lines, deleting, sorting on this tab are not available.

- Subdivision. The department is the recipient of the costs. The attribute value is selected from the "Subdivisions" reference book.

- Organization division . The organizational unit is the recipient of the costs. The value of the attribute is selected from the reference book "Subdivisions of organizations".

- Order. Specifies the purchase order or production order for which costs are reflected. The value is selected from the list of documents "Order of the buyer" or "Order for production".

- Cost item. A cost item that reflects the output of products or services rendered. Filling in this requisite means the fact that the products manufactured or services rendered are reflected in the costs. The attribute value is selected from the "Cost Items" directory.

- In t.hours released over the limit. Specifies the quantity of products that is written off to costs in excess of the limit. Data is indicated only if: the mechanism for limiting the release of materials and semi-finished products to subdivisions is used, the “Allow limit exceeding” flag is set in the header of the document, the write-off of products goes to costs, and not to the warehouse.

- Har-r costs. The column displays the nature of the costs corresponding to the cost item selected in the line.

- Analytics type

- Analytics. Cost item analytics. The values entered in this column depend on the nature of the costs selected in the line of the cost item.

- Products. The requisite is available if the cost item with the nature of the costs "Marriage in production" is indicated. If necessary, the products to which the costs of marriage are related are indicated here.

- Cost account (BU).The accounting account that reflects the costs. The attribute value is selected from the chart of accounts and is filled in automatically when selecting an item of expenditure.

- Cost account (NU).The tax account that reflects the costs. The attribute value is selected from the chart of accounts for tax accounting and is filled in automatically when selecting an expense item or selecting an accounting cost account.

The tabular part can be filled in automatically by clicking the button " Fill in"- "Fill from template". In the “Production report for a shift” documents, for each position of the released products, you must indicate the direction of release. If the option “for costs (list)” is selected, then the input of the direction of write-off of production costs is indicated in the dialog box “Enter directions of write-off of products (services)”. For frequent use of the same combinations of values for the details of the release direction description, they can be defined in a template. For this purpose, the reference book "Directions for writing off products (services)" is intended.

Materials tab

Checkbox " Enter cost items by line determines how cost items will be entered on this tab. Setting this flag determines the indication of the cost item in each line of the tabular section.

- Cost item. The cost item is indicated for which materials and semi-finished products in work in progress were reflected. The attribute value is selected from the "Cost Items" directory. Only items with the material cost type can be specified in the attribute.

The tabular part indicates the materials and semi-finished products that were used to manufacture products, provide services:

- Material. Used material. The attribute value is selected from the "Nomenclature" reference book.

- Material characteristic . Characteristic of the material, if accounting is kept for this material by characteristics. The value of the attribute is selected from the reference book "Characteristics of the nomenclature".

- Material Series. Material series, if the material is accounted for by series. The attribute value is selected from the "Nomenclature series" reference book.

- Places. Number of places of used material.

- Unit. The unit of measure for the used material.

- Quantity. The amount of used material in the storage unit of residues. The attribute value is filled in automatically when specifying the number of seats.

- Release type. Type of output for which the material was used. The value of this attribute must be equal to the values specified on the "Products and Services" tab.

- Order costs. The cost order for the production for which the material was used. The value of this attribute must be equal to the values specified on the "Products and Services" tab.

- Order release. The order for which the material was used. The value of this attribute must be equal to the values specified on the "Products and Services" tab.

- Specification. The specification according to which the material was used.

The tabular part can be filled in automatically by clicking the button " Fill in". The following filling options are available:

- Fill in according to specification . Data on materials according to the specification is added to the tabular part.

- Fill in with the selection of analogues . When filling out, it is possible to replace materials with analogues. Replacement is performed in the assistant window "Selection of materials and analogues for production", which displays information about possible analogues, about the remains of materials and analogues in work in progress and in stock. Moreover, if the same analogue is provided for different materials, its free balance will be distributed proportionally among all materials.

- Fill in the rest . Data on materials are added to the tabular section according to the balances listed at the time of filling out the document in work in progress.

- Fill in as needed. The tabular part is filled in according to the list of materials specified on the “Materials” tab in the “Production order” document, while filling in takes place according to the current (not closed) needs of this production order. The “Order for production” documents that should be filled in are determined by the orders that are indicated in the “Order-output” column on the “Products” tab in the production report for the shift. If in the tabular section on the "Materials" tab in the production report for the shift there were already completed rows, then they will be deleted during automatic filling according to needs.

- Add from claim-invoice . The user selects the document "Requirement-invoice". The tabular part is filled in according to the list of materials specified in the document "Requirement-invoice" on the "Materials" tab, while the lines are added to the lines already in the tabular part.

Material Distribution Tab

The tabular part indicates the distribution of materials and semi-finished products indicated on the “Materials” tab for manufactured products and services rendered indicated on the “Products and Services” tab.

- Material, Material characteristic, Material series, Line item . Corresponding values from the tabular section on the "Materials" tab. The "Cost item" attribute is available for editing if the "Enter cost items by lines" checkbox is checked on the "Materials" tab.

- Quantity. Quantity of material in the storage unit of residuals.

- Nomenclature group, Products, Product characteristic, Product series, Type of output, Order costs, Order output, Specification, Cost account (BU), Cost account (NU), Quality

- WIP Division, WIP Organization Division . Available if the "Use WIP subdivision" checkbox is checked in the details visibility settings.

- WIP item group, WIP order . Available if the "Use WIP analytics" checkbox is selected in the details visibility settings.

It is possible to fill in this tabular section by clicking the "Fill" button. Materials and semi-finished products indicated on the "Materials" tab are distributed among the manufactured products in proportion to the values in the "Cost Share" column. Each material is allocated only to those production lines whose BOM includes the specified material. Materials for which a buyer's order is specified are allocated only to the production of products for this order.

Bookmark “Tech. operations"

The tab in the tabular section contains data on the performed technological operations:

- Technological operation. Completed technological operation. The attribute value is selected from the "Technological operations" reference book.

- Release type. The type of output for which the technological operation was performed. The value of this attribute must be equal to the values specified on the "Products and Services" tab.

- Cost item. A cost item that reflects technological operations in work in progress. The attribute value is selected from the "Cost Items" directory. In the attribute, you can only specify intangible items with a cost type not equal to "Material".

- Rate. Cost per unit of technological operation. The value of the attribute is filled in automatically according to the data of the "Technological operations" reference book.

- Currency. Currency of technological operation price. The value of the attribute is filled in automatically according to the data of the "Technological operations" reference book.

- Quantity. The number of technological operations performed.

- Amount in rate currency . The amount of completed operations in the currency of the technological operation rate. The attribute value is calculated automatically after entering the quantity.

- Sum. The amount of transactions performed in the currency of management accounting. The attribute value is calculated from the amount in the rate currency.

- Amount (regl).The amount of transactions performed in the currency of regulated accounting. The attribute value is calculated from the amount in the rate currency.

- Order. The production cost order (purchase order or production order) on which the manufacturing operation was performed.

- Analytics type. The column displays the name of the analytics that must be specified for the cost item selected in the row in the "Analytics" column.

- Analytics. Cost item analytics.

- Products. The requisite is available if the main cost item of the specified technological operation has the nature of the costs "Rejection in production". If necessary, the products to which the costs of marriage are related are indicated here.

- Project. Project or types of distribution by projects. The requisite is indicated if the system keeps records of indirect costs for projects.

For the purposes of accounting and tax accounting, the following are indicated:

- Cost account (BU).The accounting account that reflects the completed technical. operations.

- Cost account (NU).The tax account, which reflects the completed technical. operations.

The tabular part can be filled in automatically according to the production flow chart.

Performers tab

On the tab in the tabular part, data on the performers are indicated, the employees are actually listed and the KTU of each of them is indicated:

- Worker. Executor work (for example, a member of a team of workers). For the order reflected in the regulated accounting, it is also required to indicate the order for the reception of the employee.

- KTU. "Coefficient of labor participation" allows you to unevenly distribute the amount of the order among the performers. The default is 1.

- Amount to be charged . The amount to be accrued to the employee in the currency of management accounting.

- Amount to be charged (regl) . The amount to be accrued to the employee in the currency of regulated accounting.

The tab “Distribution of those. operations"

The tabular part indicates the distribution of technological operations indicated on the tab “Tech. operations” on products and services provided, indicated on the “Products and Services” tab.

- Technological operation, Cost item . The corresponding values from the tabular part on the tab "Tech. operations."

- Sum. The amount of transactions performed in the currency of management accounting.

- Amount (regl).The amount of transactions performed in the currency of regulated accounting.

- . Corresponding values from the tabular section on the "Products and Services" tab.

It is possible to fill in this tabular section by clicking the "Fill" button. Technological operations indicated on the tab “Tech. operations” are distributed among the products produced in proportion to the values in the “Share of value” column. Those. operations for which a buyer's order is specified are allocated only to the output of products for this order.

Other costs tab

The tab in the tabular section contains data on other intangible costs:

- Cost item. A cost item that reflects other costs in work in progress. The attribute value is selected from the "Cost Items" directory. In the attribute, you can only specify intangible items with a cost type not equal to "Material".

- Distribution method . The method of cost distribution indicates on which basis the costs will be distributed when posting the "Cost calculation" document. This is actually an analytic for which costs are reflected in WIP.

- Nomenclature group . Nomenclature group of output, to which other costs are related. The value of this attribute must be equal to the values specified on the "Products and Services" tab.

- Release type. The type of output to which other costs are related. The value of this attribute must be equal to the values specified on the "Products and Services" tab.

- Order. Order is the cost of a product that includes other costs. The value of this attribute must be equal to the values specified on the "Products and Services" tab.

- Sum

- Amount (regl).The amount of other costs in the currency of regulated accounting. The attribute value is calculated automatically when changing the amount in the control currency. accounting.

By pressing the button " Fill in" - « Fill in the rest" the tabular part is filled with the balances of intangible costs in work in progress;

Tab "Distribution of other costs"

The tabular part indicates the distribution of other costs indicated on the "Other costs" tab for manufactured products and services rendered indicated on the "Products and Services" tab.

- Cost item. The values of the relevant details from the tabular section on the "Other costs" tab.

- Sum. The amount of other costs in the currency of management accounting.

- Amount (regl).The amount of other costs in the currency of regulated accounting.

- Nomenclature group, Products, Product characteristics, Product series, Type of release, Order, Specification, Cost account (BU), Cost account (NU), Quality

It is possible to fill in this tabular section using the button " Fill". The costs indicated on the "Other costs" tab are distributed among the manufactured products in proportion to the values in the "Cost share" column. Other costs are distributed for the production of products for the same item group and order, which are indicated in the line of the tabular part "Other costs".

Bookmark "Returned waste"

For returnable waste, you can specify a separate warehouse for transfer, the warehouse is set in the "Warehouse" attribute on the "Returned Waste" tab.

The tabular part indicates the returnable waste that was generated during the production of products:

- Nomenclature. Return waste. The attribute value is selected from the "Nomenclature" reference book.

- Characteristics of the nomenclature . Characteristics of returnable waste, if records are kept for this returnable waste by characteristics. The value of the attribute is selected from the reference book "Characteristics of the nomenclature".

- Nomenclature series . A series of returnable waste, if this returnable waste is accounted for by series. The attribute value is selected from the "Nomenclature series" reference book.

- Places. Number of places of returned waste received.

- Unit. The unit of measure for the returned waste received.

- Quantity. Quantity of returnable waste received in the residue holding unit. The attribute value is filled in automatically when specifying the number of seats.

- Release type. The type of product output for which the returnable waste was received. The value of this attribute must be equal to the values specified on the "Products and Services" tab.

- Order costs. A product cost order for which a returnable waste was received. The value of this attribute must be equal to the values specified on the "Products and Services" tab.

- Reserve order. To be filled in if it is necessary to reserve returnable waste on order. The value is selected from the lists of "Buyer's Order", "Internal Order" or "Production Order" documents.

- Nomenclature group . The nomenclature group of output is indicated

- Specification. The specification of the released product or service is indicated according to the release of which the returnable waste is obtained. The attribute value is selected from the "Nomenclature Specifications" reference book.

- party status.Specifies the status of the batch, which allows you to distinguish between goods and materials in batch accounting. For returnable waste that belongs to the giver, the status of the batch "For recycling" is indicated.

It is possible to fill in this tabular section by clicking the "Fill" button. Filling is made on the basis of the release specifications, which are indicated on the "Products and Services" tab.

Bookmark "Distribution of returnable waste"

The tabular part indicates the distribution of returnable waste indicated on the tab "Returned waste" for manufactured products and services rendered indicated on the tab "Products and services".

- Nomenclature, Nomenclature characteristic, Nomenclature series, Cost item . Values of the relevant details from the tabular section on the "Returnable Waste" tab.

- Quantity. Quantity of returnable waste in the residue holding unit.

- Nomenclature group, Products, Product characteristic, Product series, Product type, Cost order, Reserve order, Specification, Cost account (BU), Cost account (NU), Quality . The values of the relevant details from the tabular section on the "Products and Services" tab.

It is possible to fill in this tabular section by clicking the "Fill" button. The nomenclature indicated on the "Returned waste" tab is distributed among the released products in proportion to the values in the "Cost share" column. If in the specification for returnable waste in the attribute “Reflection of return. waste” method is specified “In distribution documents”, automatic distribution of returnable waste in the shift production report cannot be performed. Each return is allocated only to those release lines whose specification includes the specified return. Lines that contain a buyer's order are allocated only to the production of products for this order.

Features of the

If the accounting policy specifies the method of forming the cost for the release operation as “At planned cost” or “At direct costs”, then when posting the document, the preliminary cost of materials is determined, according to the accounting data in work in progress, and distribution is performed according to the number of direct costs of this material on the lines of the tabular part "Products and Services". As a result, the preliminary cost of products manufactured and services rendered is formed.

When posting the “Production Report for a Shift” document, the requirements for the production order specified in it are closed if:

- records the needs of orders for production (in the settings of the accounting parameters, the flag "Keep a record of the needs of orders for production in materials and semi-finished products" is set);

- when using the "Automatically at distribution" method of closing requirements, requirements are closed based on the data on the "Materials distribution" tab. In this case, there are the following features of closing needs:

- if, as a result of holding the document, it is completely released product position, scheduled for release on a production order - is closing all need products

- if as a result of the document all products, scheduled for release on a production order, is fully released, the requirement for a production order is being closed in full regardless of the information specified on the tab "Distribution of materials";

- when using the “Explicit” requirements closure method, requirements are closed in the following cases

- as a result of the document is fully released product position scheduled for release on a production order. At the same time, it closes all need production order associated with this products

- as a result of the document all products, scheduled for release on a production order, is fully released. At the same time, the requirement for a production order is closed. in full.

In this article, we will consider an example of the production of Assorted sweets, the preparation of a production report for a shift and output at the end of the month.

Before proceeding with further work with the program, it must be configured. In the "Main" menu, click on the "Functionality" link. In the window that appears, open the "Production" tab. The flag at the point of the same name must be set.

In our case, this flag is not editable. The reason lies in the fact that earlier in this program the documents corresponding to the “Production” section were already created. We can view them using the hyperlink below, as shown in the image.

Before us opened a list of all existing documents, the presence of which determines the use of this functionality and does not allow you to disable it.

note that in our case, the planned price in the production report for the shift was correctly determined and filled in automatically. If this does not happen to you, install them at the appropriate .

As you may have noticed, in the last column we have indicated the specification. Its use will reduce the time for filling the component materials from which our products are made.

Our specification card contains its name, nomenclature - Assorted sweets, which are our finished products. Further, the consumption rate is specified - for one piece.

The tabular part lists those materials with an indication of the quantity from which our sweets will be made. As a result, it turns out that 300 grams of cocoa powder, 100 grams of cocoa beans, 350 grams of palm oil, etc. will be spent on one unit of Assorted sweets, etc.

Let's go back to the shift production report and go to the "Materials" tab. After clicking on the "Fill" button, five rows were added to the corresponding tabular section. As you can see, these are exactly the materials that were specified in the specification.

note that for all materials in full there should be a balance in the warehouse.

Due to the fact that with this document we produce 1000 assorted sweets, then, accordingly, the number of components was also calculated based on the specification. Thus, the specification allows you to simplify the input and calculation of materials, as well as eliminate manual input errors and the "human factor".

After filling in and checking all the necessary data, we will draw up the document and open its movements. As you can see in the image below, all materials are assigned to the main production. Sweets "Assorted", which are manufactured products - to account 43.

See also video instruction:

Calculation of the cost of manufactured products

If we create a balance sheet for account 43 now, we will see that Assorti sweets have a planned price. It is equal to 215,000 rubles.

In order to see the actual cost, we will re-form the turnover already on the 20.01 account. As you can see in the figure, it is 171,063.50 rubles. The fact is that the cost adjustment is made at the close of the month.

Closing the month is done using a special assistant, which is located in the "Operations" menu. In this case, we will close September 2017. Adjustment of the cost of Assorted sweets issued by us will be made by closing accounts 20, 23, 25, 26.

After the closing of the month, we can generate a certificate-calculation of the cost of produced sweets.

Using the help-calculation "Cost calculation", let's see in detail what costs were included in the main nomenclature group, which includes the produced "Assorti" sweets.

note that in this example, only the costs of the materials themselves were attributed to the production of sweets. In reality, the cost will include such expenses as workers' wages, etc. The program will automatically calculate everything in proportion to the finished product produced in a month.

Having re-formed the balance sheet for account 43 after the close of the month, we will make sure that the cost of sweets has been adjusted.

The document "Report of production for a shift" is one of the key documents of production accounting in the program "1C: Accounting 8". It is designed to reflect the following operations in accounting and reporting:

release of finished products, semi-finished products of own production, goods and materials;

provision of services to the production units of their own enterprise;

write-off of raw materials and materials for production costs;

release of returnable waste.

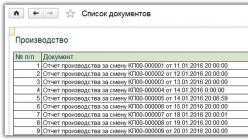

To start working with the "Production report for a shift" documents, execute the main menu command Production | Production report per shift. You can also switch to this mode from the function panel using the link Production report for a shift on the tabs Production | Output or Production | Recycling. In any case, a window with a list of previously generated documents will open on the screen:

List of production reports per shift

If documents of this type have not been created so far, the window will be empty, and positions will be added to it as documents are generated. For each document, the list displays general information by which it can be identified: date and time of formation, number, name of the warehouse and organization, an arbitrary comment, and the name of the user responsible for compiling this document. For each posted document (the symbol in the leftmost column informs about the posting of the document, both documents are posted), you can see the result of its posting. To do this, select a document in the list with a mouse click and execute the Actions | The result of the transaction, after which a window with accounting entries generated according to the document will be displayed on the screen:

The result of the document